- December 4, 2024

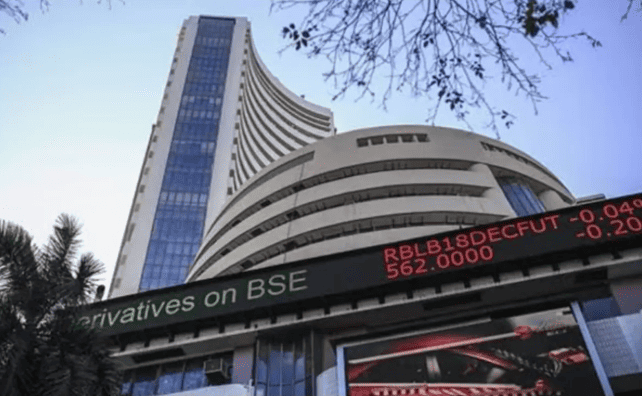

Stocks of ITC, Varun Beverages, and Godfrey Phillips Decline Amid GST Hike Report

In a turbulent turn of events for investors, stocks of several major companies, including ITC Limited, Varun Beverages, and Godfrey Phillips India, witnessed a significant decline following reports of a potential Goods and Services Tax (GST) hike. The proposed increase in the GST rates on various consumer goods and services has created uncertainty in the market, particularly impacting the shares of companies operating in sectors such as cigarettes, beverages, and tobacco products. Investors are concerned that the tax increase will adversely affect the profitability and sales of these firms, thereby contributing to the downward movement in their stock prices. The news of a possible hike in GST rates comes in the wake of discussions among Indian policymakers aimed at increasing tax collections to support the country’s fiscal deficit. While the exact details of the GST revision are still being worked out, reports suggest that the tax could be raised on certain products, particularly in the sin goods sector, which includes tobacco, alcoholic beverages, and sugary drinks. These sectors are already subjected to relatively high tax rates, and any further increase is expected to burden both companies and consumers, potentially slowing down demand. The stocks of ITC, Varun Beverages, and Godfrey Phillips are particularly vulnerable to these changes, as their core business operations revolve around products likely to face higher taxes. ITC, a dominant player in the cigarette and packaged food industries, is the most directly impacted. A significant portion of the company’s revenues comes from its tobacco business, which already faces substantial excise duties and GST. An increase in the tax burden could lead to higher product prices, reduced demand, and a squeeze on margins, all of which could have a negative effect on the company’s profitability. Varun Beverages, the franchisee for PepsiCo in India and other South Asian markets, also felt the impact. Given that sugary beverages are often subject to higher tax rates, any GST increase could make these products more expensive for consumers, potentially leading to a drop in consumption. This, in turn, could hinder the company’s ability to maintain its profit margins and growth trajectory.

Similarly, Godfrey Phillips, another major player in the tobacco and cigarettes segment, saw a considerable decline in its stock price. The company is one of the largest manufacturers of cigarettes in India, and the potential increase in GST would disproportionately affect its operations. With the government’s push to raise tax rates on tobacco products in order to discourage smoking and increase revenue, Godfrey Phillips faces an uphill battle to preserve its market position and profitability in a more competitive and heavily taxed environment. Investor sentiment has been notably negative following the reports of the proposed GST hike. The decline in stock prices of these companies reflects broader concerns that the increased tax burden will hurt their earnings potential, particularly in the short to medium term. Analysts have raised questions about the ability of these firms to pass on the additional tax costs to consumers, especially in a price-sensitive market like India, where consumers may be fast to switch to cheaper alternatives or reduce their consumption. In addition to the direct impact on revenue and margins, the broader implications of the tax increase are also creating unease in the market. A hike in GST could signal a more aggressive fiscal approach by the government, which could lead to further regulatory challenges for businesses across multiple sectors. As a result, many investors are adopting a cautious stance, pulling back from stocks that may face significant pressure in the coming quarters. For now, however, ITC, Varun Beverages, and Godfrey Phillips remain under scrutiny, and investors are advised to closely monitor developments in the GST discussions. Any official announcements regarding tax hikes will likely determine the next steps for these companies and their stock prices.In conclusion, while the proposed GST hike has triggered a decline in stock prices of ITC, Varun Beverages, and Godfrey Phillips, the long-term outlook for these companies will depend on how the adapt to potential regulatory changes. In the near term, however, the uncertainty surrounding the tax increase continues to weigh heavily on investor sentiment.

The post Stocks of ITC, Varun Beverages, and Godfrey Phillips Decline Amid GST Hike Report first appeared on InfluencersPro.